[ad_1]

How to Stay Motivated to Achieve Financial Goals

Setting financial goals is an essential part of personal finance management. Whether it’s saving for a big purchase, paying off debt, or investing for the future, having clear financial goals provides direction and purpose to your money management. However, staying motivated to achieve these goals can be challenging, especially when faced with setbacks or obstacles. In this article, we’ll explore some strategies to help you stay motivated and focused on your financial goals.

Set Clear and Attainable Goals

The first step in staying motivated to achieve financial goals is to set clear and attainable goals. Vague or unrealistic goals can be demotivating, as they may seem too daunting or unattainable. Instead, break down your long-term financial goals into smaller, achievable milestones. For example, if your goal is to save $10,000 for a down payment on a house, set monthly or quarterly savings targets to track your progress. Having clear, actionable goals will make it easier to stay motivated as you can track your progress along the way.

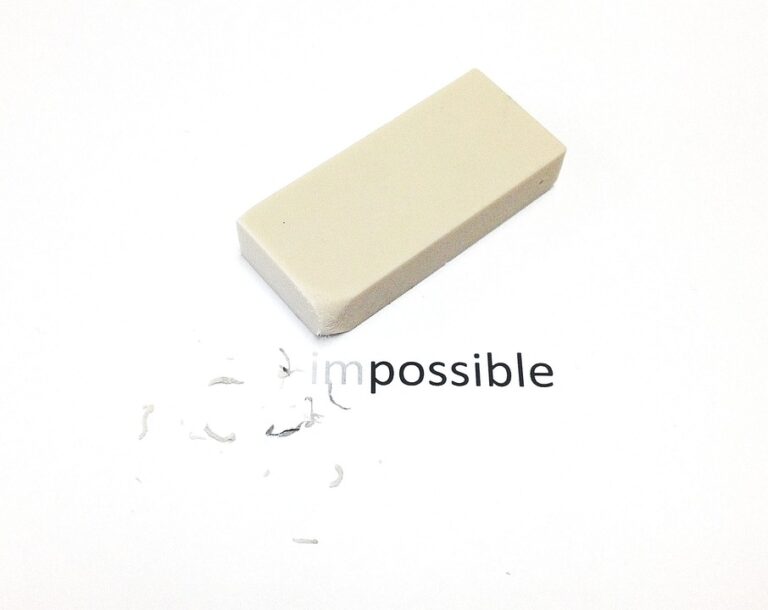

Create a Visual Reminder

Visual reminders can be powerful motivators when it comes to achieving financial goals. Try creating a vision board or a savings thermometer to visually represent your financial goals. For example, if your goal is to pay off student loans, create a visual representation of the total amount owed and mark your progress as you make payments. Seeing your progress can reinforce your motivation and remind you of the ultimate goal you’re working towards.

Find an Accountability Partner

Having someone to hold you accountable can help you stay on track with your financial goals. Whether it’s a friend, family member, or a financial advisor, sharing your goals with someone you trust can provide support and encouragement when you need it most. Additionally, having an accountability partner can help you stay motivated by sharing your progress and celebrating your achievements along the way.

Reward Yourself Along the Way

Staying motivated to achieve financial goals is easier when you have rewards to look forward to. Incorporate small rewards into your financial plan to celebrate your progress and keep your motivation high. For example, if you reach a savings milestone, treat yourself to a small indulgence, such as a dinner at your favorite restaurant or a weekend getaway. Recognizing your hard work with small rewards can help you stay motivated and focused on the bigger picture.

Overcoming Setbacks and Staying Resilient

It’s important to acknowledge that setbacks are a natural part of the journey towards achieving financial goals. Whether it’s an unexpected expense, a temporary job loss, or a market downturn, setbacks can be demotivating and test your resilience. In these times, it’s crucial to remind yourself of the long-term benefits and refocus on your goals. Reflect on past achievements, seek support from your accountability partner, and adjust your plan if needed. By staying resilient and adaptable in the face of setbacks, you can maintain your motivation and continue working towards your financial goals.

Conclusion

Staying motivated to achieve financial goals is a journey that requires perseverance, resilience, and a clear vision of your objectives. By setting clear and attainable goals, creating visual reminders, finding an accountability partner, rewarding yourself along the way, and staying resilient in the face of setbacks, you can maintain your motivation and stay focused on your financial goals. Remember, the journey towards financial success is a marathon, not a sprint, and staying motivated is key to reaching your desired destination.

Real-Life Examples

Emily, a recent college graduate, set a goal to pay off her student loans within five years of starting her career. She created a visual tracker to monitor her progress and shared her goal with her parents, who became her accountability partners. Along the way, she rewarded herself with small treats for reaching savings milestones, such as a weekend getaway with friends. When faced with unexpected expenses, Emily stayed resilient and adjusted her plan, ultimately achieving her goal ahead of schedule.

FAQs

How do I stay motivated when my financial goals seem overwhelming?

Break down your long-term goals into smaller, achievable milestones. This will make the overall goal seem more manageable and allow you to track your progress more effectively.

What should I do if I experience a setback in my financial journey?

Setbacks are natural and should be expected. Stay resilient, seek support from your accountability partner, and make adjustments to your plan if needed. Remember that setbacks are temporary and should not deter you from reaching your long-term goals.

How can I create a visual reminder for my financial goals?

You can create a vision board, a savings thermometer, or even a simple chart to visually represent your financial goals. This visual reminder can serve as a motivator and keep your goals top-of-mind as you work towards achieving them.

[ad_2]